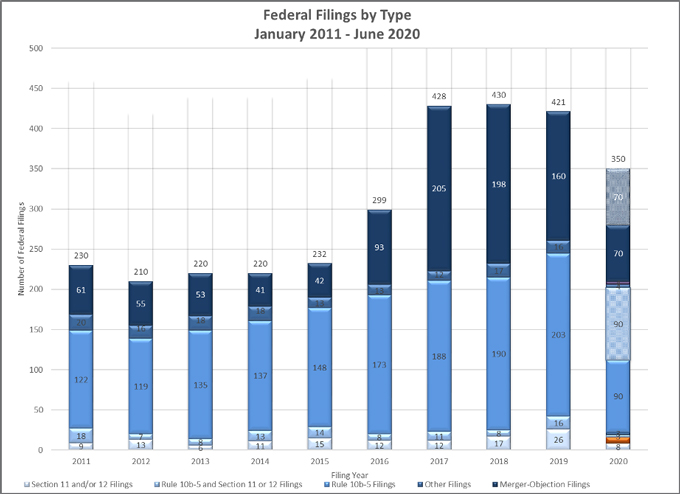

The act was passed in large part as a response to the stock market crash of 1929 to provide more transparency in the secondary securities market.

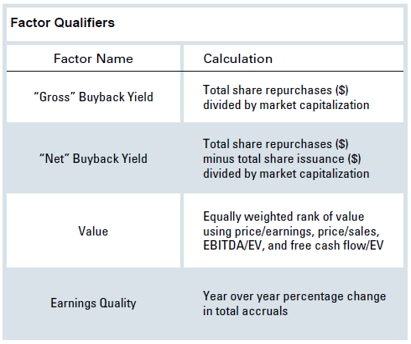

Securities exchange act rule 10b 18.

Rule 10b 18 is a securities and exchange commission sec rule that is intended to reduce liability for companies and their affiliated purchasers when the company repurchases shares of the.

Ii for securities for which bids and transaction prices are not quoted or reported in the consolidated system rule 10b 18 purchases must be effected at a purchase price that does not exceed the highest independent bid or the last independent transaction price whichever is higher displayed and disseminated on any national securities exchange or on any inter dealer quotation system as defined in 240 15c2 11 that displays at least two priced quotations for the security at the time.

240 10b 5 is one of the most important rules targeting securities fraud promulgated by the u s.

The rule prohibits any act or omission resulting in fraud or deceit in connection with the purchase or sale of any security.

Securities and exchange commission pursuant to its authority granted under 10 b of the securities exchange act of 1934.

The amendments are intended to simplify and update the safe harbor provisions in light of market developments since the rule s adoption.

27 2020 rule 10b 18 amendments.

What is rule 10b 18.

The securities and exchange act of 1934 created the sec and section 10b of the act gave the sec the power to enact rules against manipulative and deceptive practices in securities trading.

Sec rule 10b 5 codified at 17 c f r.

/SEC-Image-bc891e3ed2ec4d07a0c233968f5deea1.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1209420474-35dd7632869948e08f7a4273aa5d3e9f.jpg)