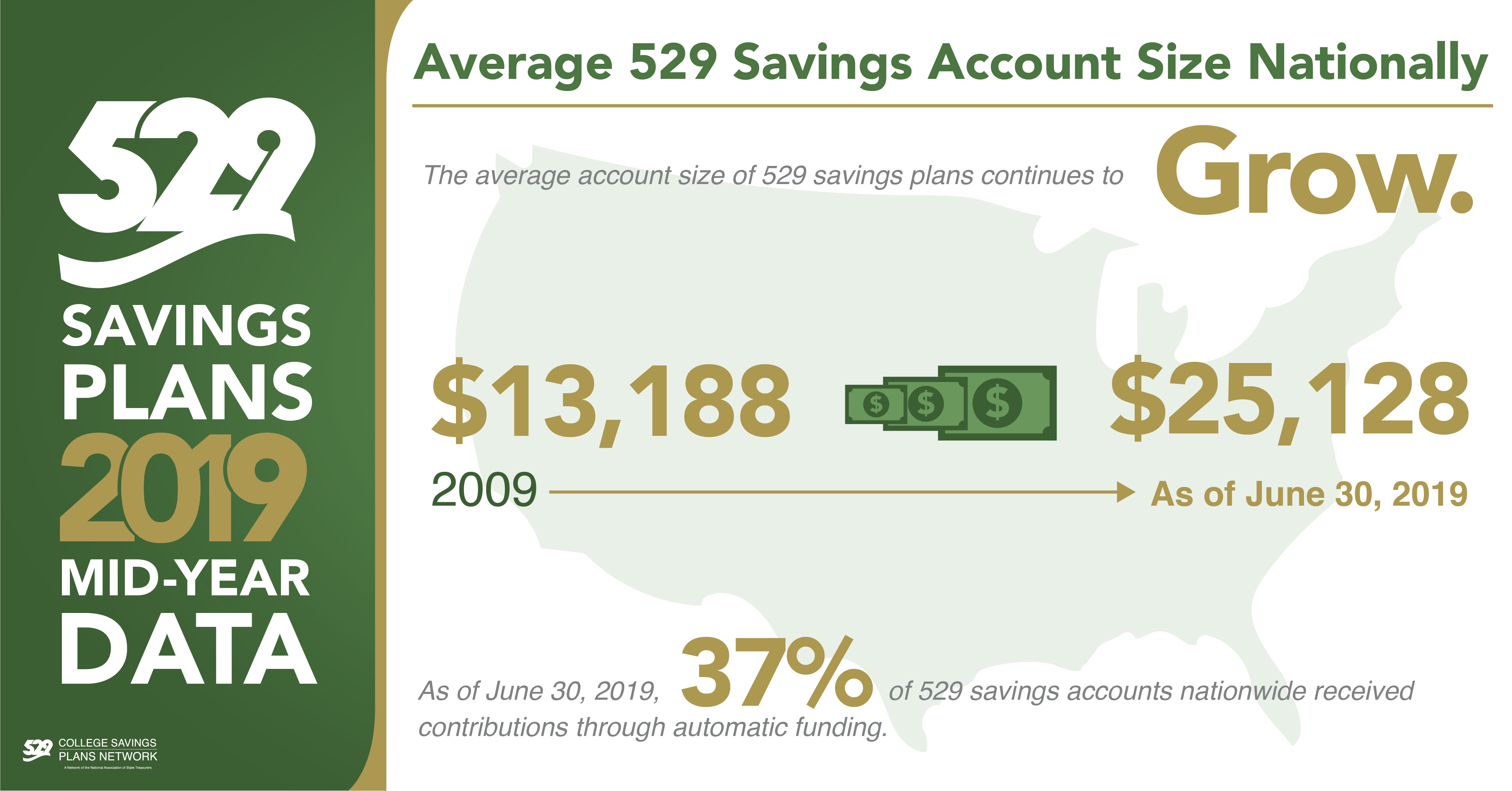

529 plans are a way to pay educational and in some cases vocational expenses and you can even pay back student loans without paying taxes or a penalty on qualified withdrawals.

Section 529 plan withdrawal rules.

You ve saved up for your kid s college for years and the big day is finally here.

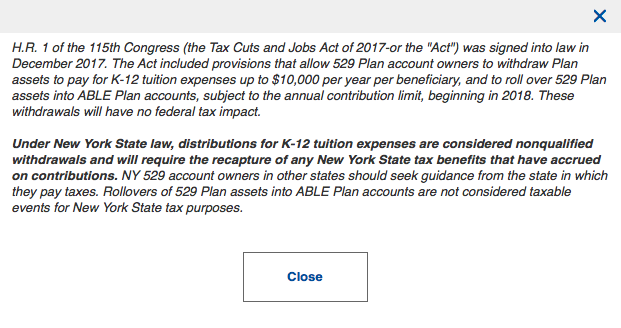

Starting january 1 2018 this definition is expanded to include up to 10 000 in k 12 tuition expenses per beneficiary per year.

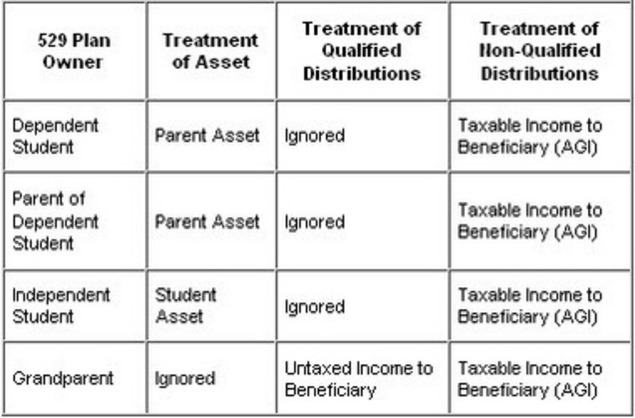

529 plan distributions used to pay for non qualified expenses are subject to income tax and a 10 penalty on the earnings portion of the withdrawal.

Withdrawing in the right way and for the proper expenses is critical if you want to make the most of the funds you ve invested even if you re not keen on studying the specific ins and outs of 529 withdrawals there are a few things you need to know.

This includes 529 distributions used to pay for airfare and other travel costs college application or testing fees health insurance or room and board costs beyond the college s cost of.

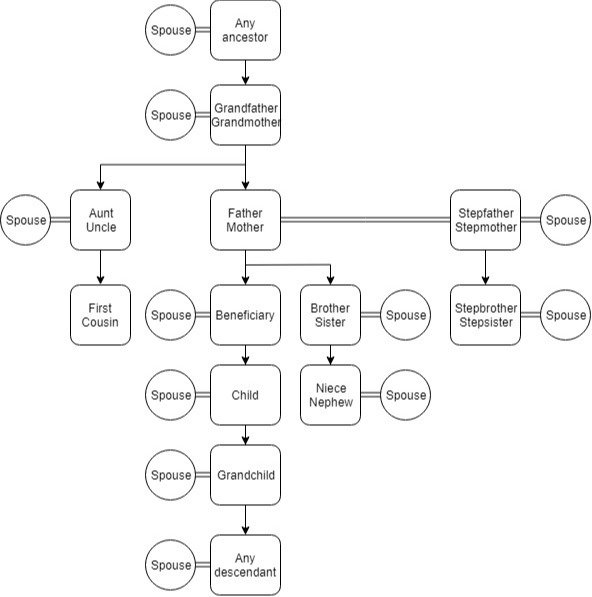

A qualified tuition program qtp also referred to as a section 529 plan is a program established and maintained by a state or an agency or instrumentality of a state that allows a contributor either to prepay a beneficiary s qualified higher education expenses at an eligible educational institution or to contribute to an account for paying those expenses.

The path act change added a special rule for a beneficiary of a 529 plan usually a student who receives a refund of tuition or other qualified education expenses.

Withdrawals from 529 plans are not taxed at the federal level as long as you understand and follow all the rules for qualifying expenses.

If the beneficiary recontributes the refund to any of his or her 529 plans within 60 days the refund is tax free.

You ll have to report your 529 plan spending to the irs so keeping careful records is important.

This can occur when a student drops a class mid semester.

Sometimes people are hesitant to open 529 plan accounts because qualified higher education expenses seem like a difficult part of the tax code to understand.

Specifically that means schools that are eligible to participate in federal student aid programs.

To qualify as a 529 plan under federal rules a state program must not accept contributions in excess of the anticipated cost of a beneficiary s qualified education expenses.

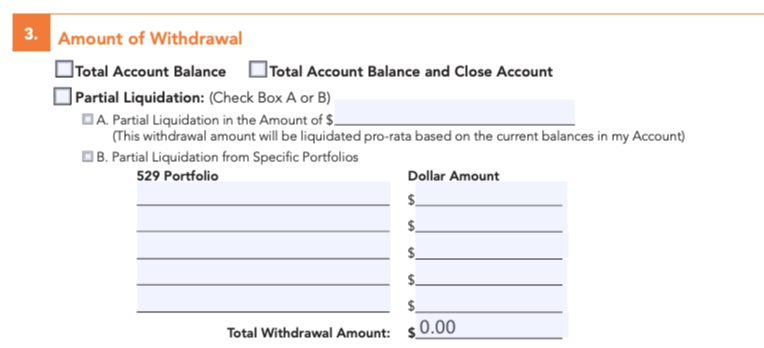

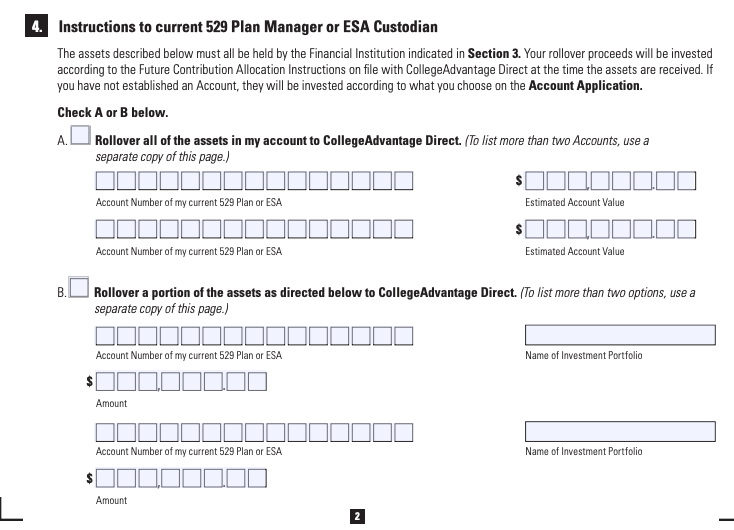

Decide ahead of time how you ll withdraw the funds and use them.

Qualified 529 plan withdrawals previously qualified 529 plan withdrawals were limited to withdrawals used to pay for higher education expenses at eligible colleges and universities.

529 plans offer tax free withdrawals when the funds are used to pay for qualified education expenses.

It s time to withdraw from your 529 savings plan.

At one time this meant five years of tuition fees and room and board at the costliest college under the plan pursuant to the federal government s safe harbor guideline.