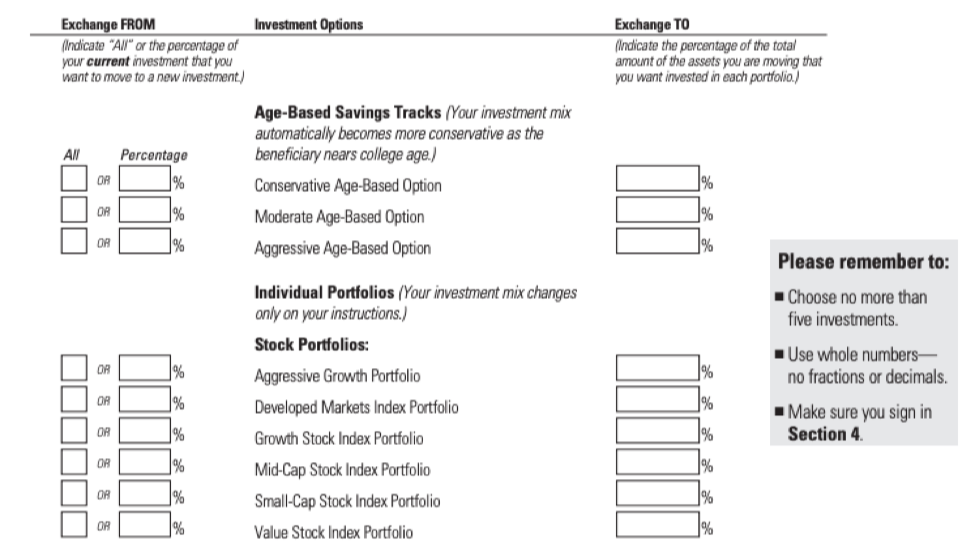

During the implementation process pa 529 ip account owners will not be able to access their accounts online or by phone from 4 00 pm est on thursday april 26 2018 until 8 00 am est on monday april 30 2018.

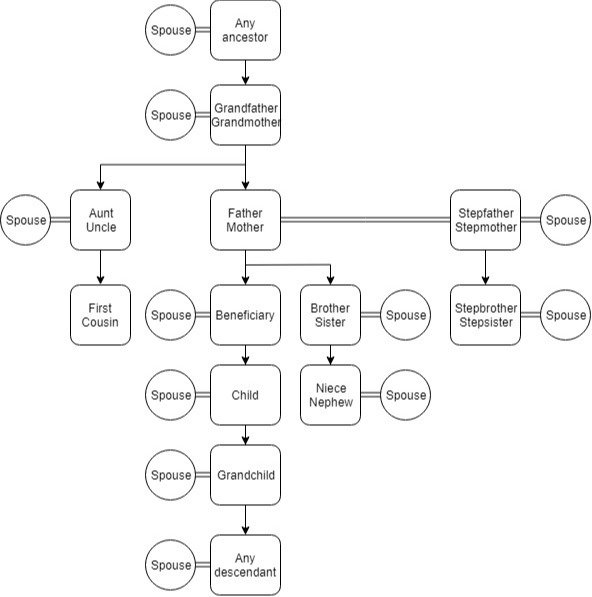

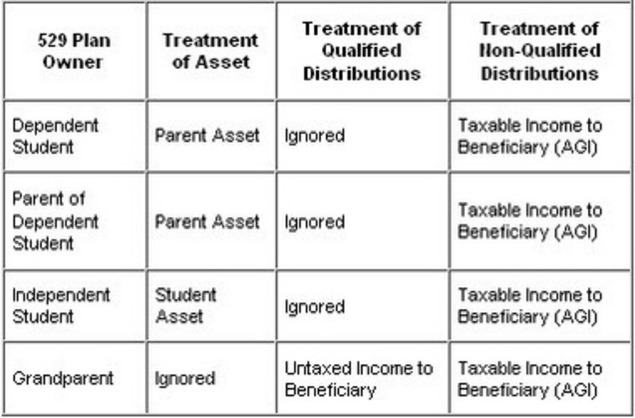

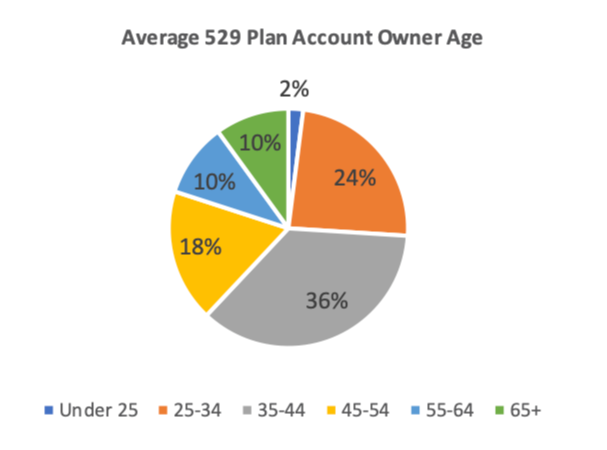

Section 529 plan ownership rules.

Details of these changes are available here.

The path act change added a special rule for a beneficiary of a 529 plan usually a student who receives a refund of tuition or other qualified education expenses.

529 plans have very specific transferability rules governed by the federal tax code section 529.

The pa 529 investment plan ip will be making some important changes which will take effect april 27 2018.

You ll have to report your 529 plan spending to the irs so keeping careful records is important.

If the beneficiary recontributes the refund to any of his or her 529 plans within 60 days the refund is tax free.

You will need to check with your 529 plan administrator about the process involved with changing ownership.

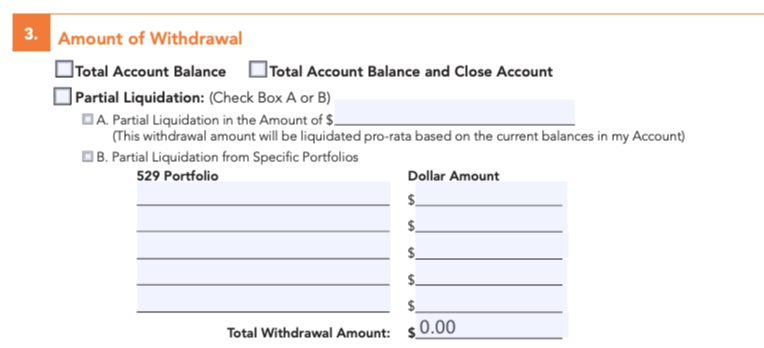

Decide ahead of time how you ll withdraw the funds and use them.

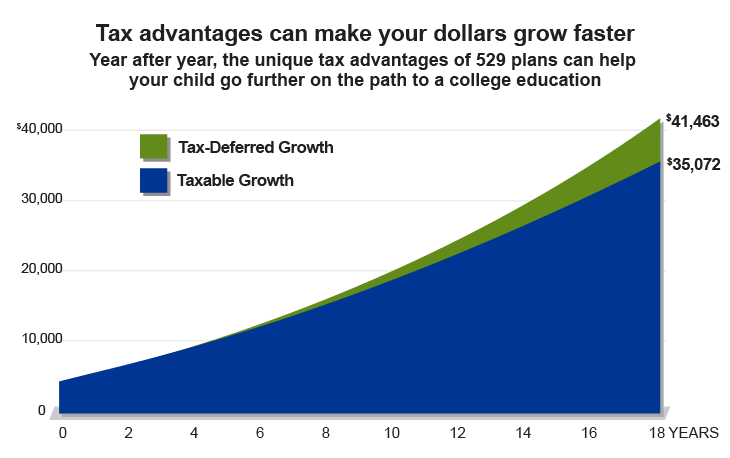

A 529 plan is a tax advantaged savings plan designed to encourage saving for future education costs.

While there are some rules to follow the tax benefits and ownership flexibility of these plans make them well worth it.

529 plans legally known as qualified tuition plans are sponsored by states state agencies or educational institutions and are authorized by section 529 of the internal revenue code.

You must have confidence that the person you name as successor will fulfill your desires for the use of.

If you have extra funds in an individual 529 plan account that you don t want to transfer to another beneficiary you might name yourself as the beneficiary and use the funds for your own future education.

A 529 college savings plan can be a big help in preparing for those costs.

This can occur when a student drops a class mid semester.

Some 529 plans have rules of succession to determine the successor owner in the event you have not named someone.

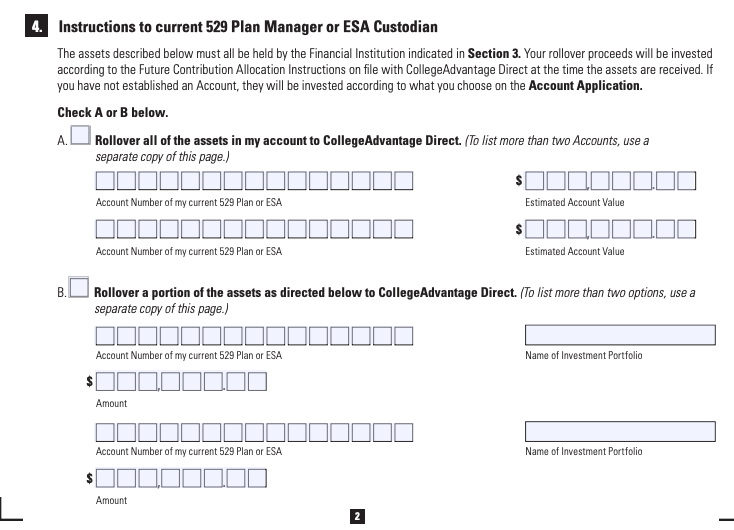

You can t however roll a 529 plan account into an ira or any other retirement plan.

Withdrawals from 529 plans are not taxed at the federal level as long as you understand and follow all the rules for qualifying expenses.

For example a 529 plan managed by fidelity investments will generally treat an owner.

The 2017 tax cuts and jobs act expanded the guidelines for 529 plans allowing parents to withdraw up to 10 000 per year from these plans for private or religious elementary and secondary education expenses.

Section 529 college savings plans should be at the top of the list for parents and others wanting to save for a loved one s education.

/GettyImages-936317872-35f1a1c79a9a4545ad7f71f05707338b.jpg)