For purposes of section 38 the amount of the low income housing credit determined under this section for any taxable year in the credit period shall be an amount equal to 1 the applicable percentage of 2 the qualified basis of each qualified low income building.

Section 42 of the lihtc program of the internal revenue code.

Internal revenue code section 42 february 3 2010.

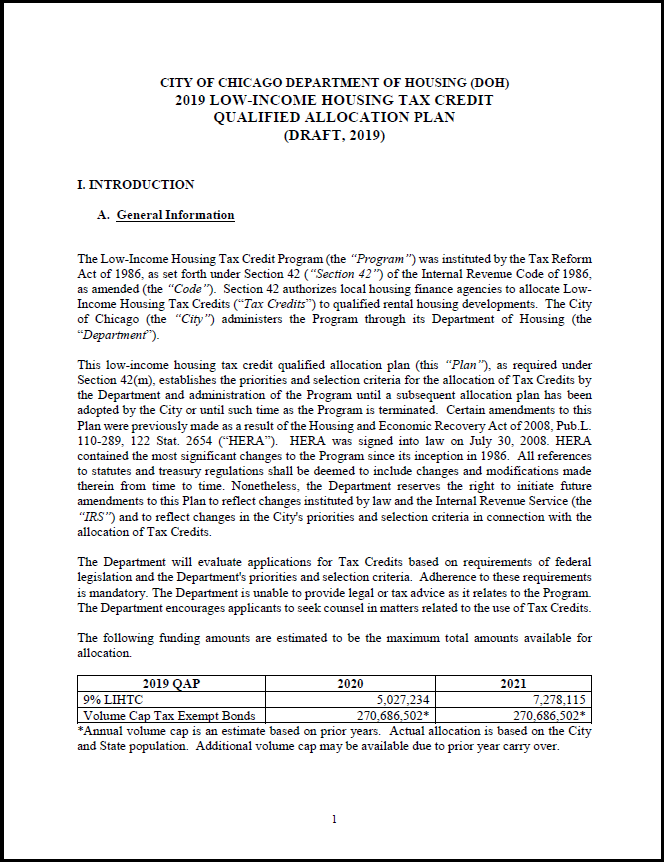

Nevada housing division administers the low income housing tax credit lihtc program and is required as the state s housing credit agency to adopt a plan describing the process for the allocation of housing credits.

Internal revenue code section 42 january 31 2013.

Internal revenue code section 42.

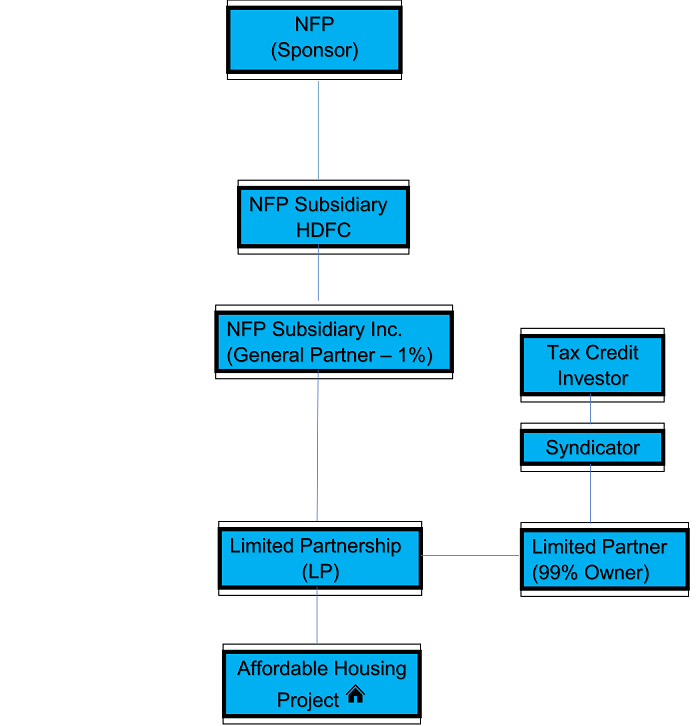

The section 42 housing program refers to that section of the internal revenue tax code which provides tax credits to investors who build affordable housing.

Internal revenue code section 42 march 23 2018.

The program regulations are under section 42 of the internal revenue code.

As a condition for receiving housing tax credits owners must keep the units.

Internal revenue code section 42 may 19 2016treasury.

Tenant qualifications for section 42 tax credit programs.

The tax credit reform act of 1986 created the low income housing tax credit program lihtc.

Internal revenue code section 42 january 28 2011.

Investors receive a reduction in their tax liability in return for providing affordable housing to people with fixed or lower income.

2004 82 purpose this revenue ruling answers certain questions about the low income housing credit under 42 of the internal revenue code.

The tax credit encourages developers to build affordable housing to meet the needs of the community.

Section 42 low income housing credit also 1 42 5 1 42 15 1 103 8 rev.

Eligible basis and qualified basis issues law.

Internal revenue code section 42 august 8 2013.

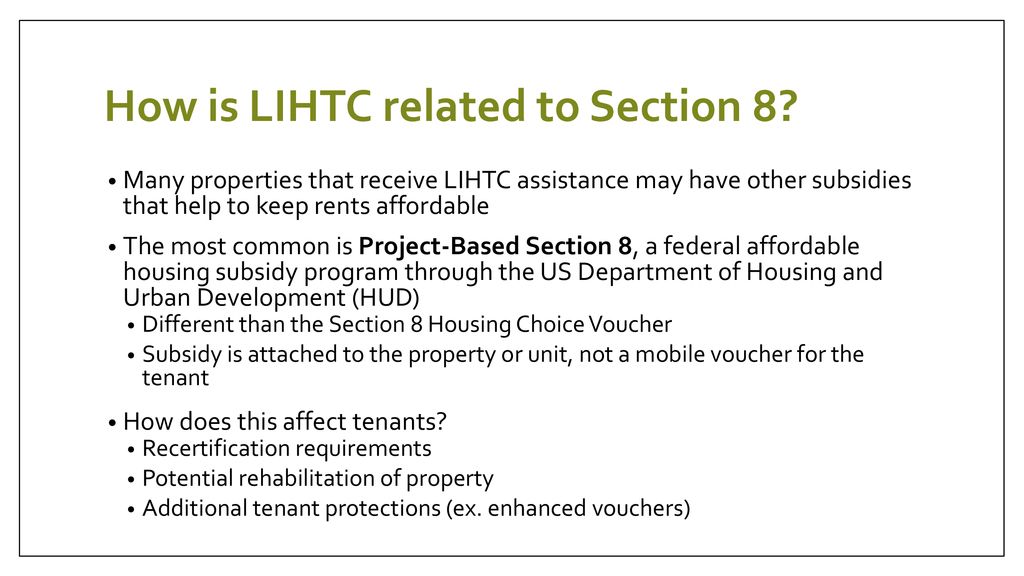

The term federally assisted building means any building which is substantially assisted financed or operated under section 8 of the united states housing act of 1937 section 221 d 3 221 d 4 or 236 of the national housing act section 515 of the housing act of 1949 or any other housing program administered by the department of.

Section 42 of the internal revenue code irc or the code is the federal statute establishing the tax credit program.

Section 42 of the internal revenue service s tax code also known as the low income housing tax credit exists to serve high need.