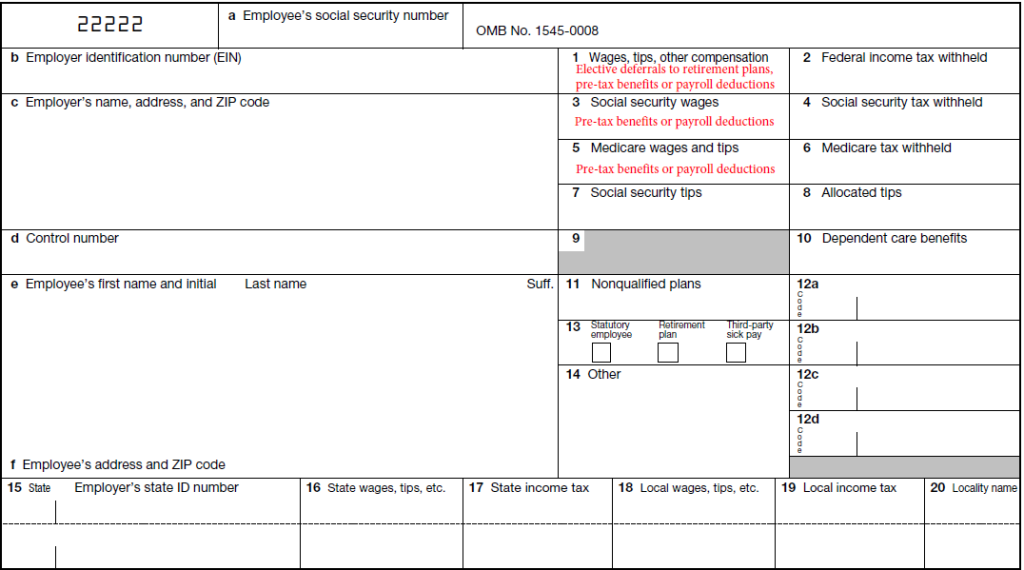

The total dependent care benefits the employer paid to the employee or incurred on the employee s behalf including amounts from a section 125 plan should be reported in box 10 of form w 2.

Section 125 flexible benefit plan form.

Any amount over 5 000 should be included in boxes 1 3 and 5 as wages social security wages and medicare wages.

Section 125 flexible benefit plan change verification election form.

Sample plan document section 125 flexible benefit plan version 01 17 the attached plan document and adoption agreement are being provided for illustrative purposes only.

This election form revokes any prior election form completed and will remain in effect and cannot be revoked or changed during the plan year unless the revocation and.

Offering competitive benefits attracts satisfies and retains top talent.

But the upkeep and compliance is often a burden.

In fact 80 of employees would choose benefits over a pay raise.

This document is intended as a.

Employer employee id.

Section 125 plans give your employees the power to choose from different benefits.

An employee can reduce their taxable income and avoid paying social security and medicare tax 5 65 and federal income tax 15 to 40 by enrolling in a company sponsored flexible benefits plan.

When you dive into different small business employee benefits you might consider section 125 plans.

A section 125 plan is called a cafeteria plan.

A section 125 plan is a valuable tool for both you and your employees.

If you re like other employers we work with it s likely been a while since you ve updated your section 125 plan document.

These benefits can include health insurance child care adoption assistance life insurance and health savings accounts.

Filing a claim before submitting your claim make sure you have had the service s.

These tax savings can apply to one or more of the following options.

Because of differences in facts circumstances and the laws of the various states interested parties should consult their own attorneys.

A section 125 plan is part of the irs code that enables and allows employees to take taxable benefits such as a cash salary and convert them into nontaxable benefits.

Section 125 plan administration.

Ir 2020 95 may 12 2020 washington the internal revenue service today released guidance to allow temporary changes to section 125 cafeteria plans.

To file your claim 1.

Attach a legible receipt s from the service provided or an eob explanation of benefits showing.

These changes extend the claims period for health flexible spending arrangements fsas and dependent care assistance programs and allow taxpayers to make mid year changes.