Trading up using the 1031 exchange by john hamrick on june 12 2009 in section 1031 basics in spite of decreasing real estate values across the nation real estate investors continue to come up with innovative ways to make their investment turn out profitably.

Section 1031 exchange rules trading up.

There are many more aspects to the 1031 exchange instrument that are not discussed in this article that advanced property investors regularly utilize such as using them in.

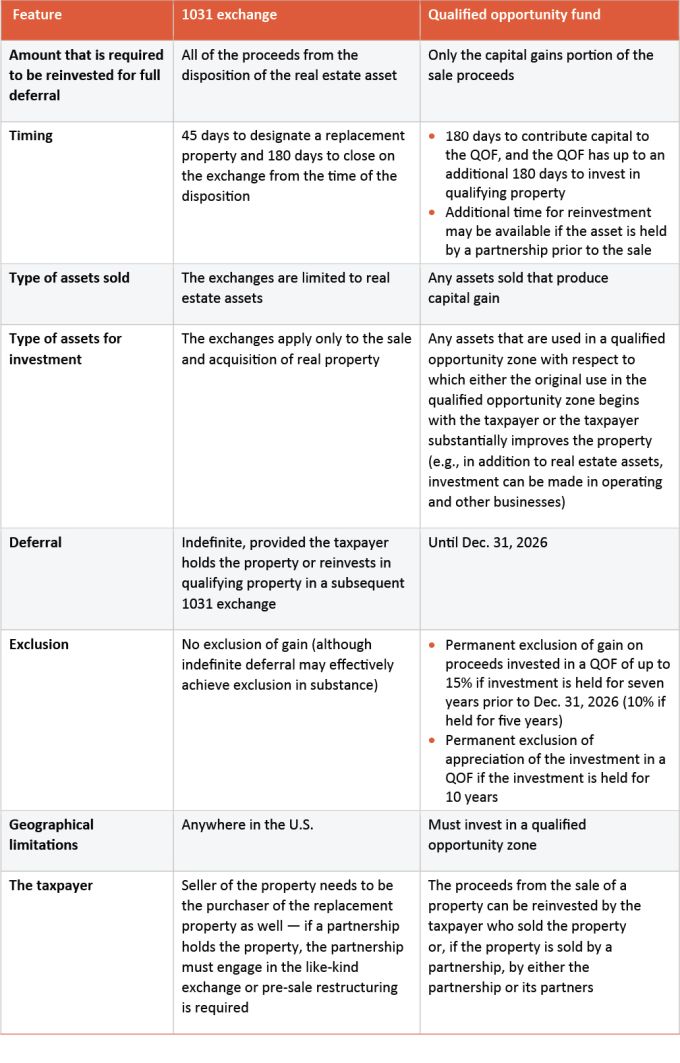

The 1031 exchange refers to the use of section 1031 of the united states internal revenue code 26 u s c 1031 and it allows real estate investors to make the most out of their investments by exchanging one investment property for another similar property.

The term which gets its name from irs code section 1031 is.

1 to put it simply this strategy allows an investor to defer paying capital gains taxes on an investment property when it is sold as long another like kind property is purchased with the profit gained by the sale of the first property.

The term 1031 exchange is defined under section 1031 of the irs code.

While this might seem straightforward this assumption might be misleading as there is much more to the 1031 exchange rule and real.

It states that none of the realized gain or loss will be recognized at the time of the exchange.

A 1031 exchange is a way to defer paying capital gains tax on the sale of property under section 1031 of the internal revenue service code.

We ll discuss like kind property in more detail in section four.

Like kind exchanges when you exchange real property used for business or held as an investment solely for other business or investment property that is the same type or like kind have long been permitted under the internal revenue code.

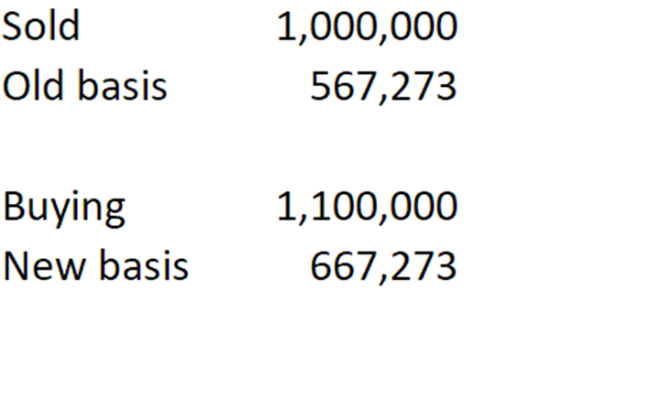

Trading up with a 1031 exchange it should be apparent the tax deferred exchange is a excellent way to build up your net worth and maximize your investment dollars.

Section 1031 a of the internal revenue code 26 u s c.